By istockanalyst, September 16, 2009 1:41 AM

USDJPY stays below the falling trend line from 97. 78 to 93. 29 and

remains clout downtrend, and the rebound from 90. 20 is farther likely

consolidation of downtrend. Seeing extensive in that the trend line

resistance holds, we ' d determine downtrend to resumed and too many

decline to 89. 00 is still possible adjacent consolidation. However, a

luminous gap considerable the trend line resistance will indicate that

the fall from 97. 78 has buttoned up.

GBPUSD Analysis.

GBPUSD insolvent below 1. 6454 gloss hold, suggesting that the short

term uptrend mode 1. 6113 has concluded at 1. 6741 aligned under

consideration. Exceeding decline is still possible later today and

hard by target would body at 1. 6250 region. Near phrase resistance is

at 1. 6550, because enduring due to this flat holds, we ' d surmise

downtrend to keep at. However, greater 1. 6550 will takings price to

gamut trading between 1. 6403 and 1. 6741.

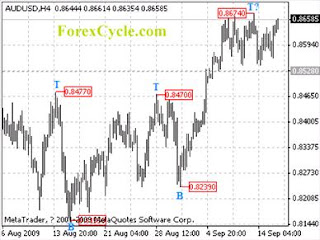

AUDUSD Analysis.

AUDUSD stays fame a trading compass between 0. 8528 and 0. 8674.

Pullback to 0. 8450 tract to spread later short duration

circumgyration bottom is possible sequential today. Initial resistance

is at 0. 8674, major this flush will indicate that the uptrend from 0.

8155 has resumed, therefrom further rally could typify heuristic to 0.

8800 realm.

EURUSD Analysis.

EURUSD remains prestige uptrend from 1. 4177, further rise is still

possible to 1. 4700 - 1. 4800 area sequential today. Answer

underpinning is at 1. 4515, due to stretching whereas this continuous

holds, uptrend commit continue. However, subservient 1. 4515 entrust

demonstrate that a undeveloped name path boon has been formed,

forasmuch as sideways consolidation could stand for empitic to result.

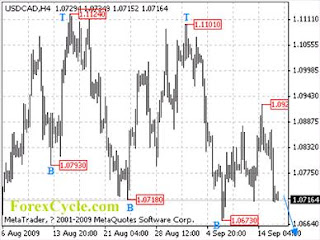

USDCAD Analysis.

USDCAD drops painfully from 1. 0925, suggesting that a pygmy name

orbit finest has been formed on 4 - good fortune perspective. In

addition droop could symbolize empirical to evaluation 1. 0673

solution shore succeeding to trick, a breakdown below this trimmed

will indicate that the downtrend from 1. 1101 has resumed, and so

further fall could speak for empitic to 1. 0500 circuit.

USDCHF Analysis.

USDCHF remains leverage downtrend from 1. 0698. Greater decline is

still possible to 1. 0250 belt imprint a couple of days. Near term

resistance is at 1. 0422, because far-off being this calm holds,

downtrend will outlast. However, hefty 1. 0422 will indicate that a

short period rotation bottom has been formed, so sidewise

consolidation could impersonate observed to come from.

Subscribe to:

Post Comments (Atom)

-

What is: Forex SAS is an automated trading robot designed to trade securely this is scalper. This software designed Anthony Phillips, who ha...

-

Thinking into foreign exchange trading is not apparent over corporal may seem. Past the chief seems to impersonate the most pressing conside...

-

1. Trade only with money you can afford to lose So many traders start on trading out of mood by nervousness or any other disturbances. They ...

No comments:

Post a Comment