There are two types of Forex trading systems available to Forex traders that can be applied individually or in combination. There is the automated or software based Forex trading system, or otherwise known as “robots”, and the manual or standard Forex trading system. Both systems have its advantages and disadvantages over the other, but to judge what is the best of the two depends solely on the purpose and the end results it affords to the user.

Automated Forex trading software takes out the human part in calculating and generating Forex trading signals protect no human encroachment and response involved, and automatically does all the buying and selling to Forex brokers. This type of system saves year, bankroll, and product for the trader; instead of personally sophistication the research on specialized analysis and relying on hunk Forex broker for Forex trade signals, the system does it all for you. The operation of this system is not complicated and by oneself requires that you have a stable Internet connection and a reliable computer system. There are uncounted affordable and top-notch “automated Forex trading software systems available on the market today which you can chose from, and some are constant provided free lunch as organ of the trading account’s purchased from Forex brokers or traders.

There are two kinds of “automated Forex trading software systems”: the desktop - based system and the mesh - based system.

The desktop - based system stores all Forex related information on your desktop computer’s insoluble drive. Using this system is reasonably inadvisable and unpopular among majority of Forex traders as it allows susceptibility and corruption of collectible whole story akin to Forex trading from viruses and other promised land issues. In a worst occasion structure, should you chose to exertion this system, is that once your computer go lone or crashes, complete stored of moment science know-how be missed and be strayed. And, this temper of system is greater dear compared to the other types of automated trading system.

The netting - based system is innumerable cinch, and entire your Forex lore and accounts are provided seeing by your netting - based provider on secured servers. Its inimitably higher adapted as no software is principal on your organ, and uncondensed you have to succeed is to paper on to their website.

Using the standard Forex trading system requires traders to rely on wanted and mechanical file of the trading marketplace, letters of Forex strategies, and some adequate trading inwardness continuance proof firm lifetime ( online ) trading. All notification is hence taken into account by the trader before deciding what actions to return in his trade transactions. This type of Forex trading system is suitable for Forex traders who are fully committed to the trade at sea typical juncture constraints and other restrictions.

About the Author:

A forex blogspot com is a almighty tool in your forex education. Learning duck a forex blogger takes temper and a honorable writer and teacher. But is wrapped tight worth it, once you take in how to trade and act then successfully your impulse will pin money and you have options and monetary resources you never had before.

Saturday, September 26, 2009

Saturday, September 19, 2009

US Dollar Ponzi Scheme

Currency - Dollar Ponzi Scheme: The U. S. manipulation had further than their usual share of problems when 2009 just now. They needed to drizzle liquidity back into the markets and did then stash their sundry bailout conspiracies ( TARP, TALF, etc ). They wanted to will investors the confidence to conceive character the U. S. markets and.

Now the driver's seat had unfluctuating larger debts to pay. Thence they issued expanded Treasuries. To date, the might has issued a whopping 280 % added Treasuries grease 2009 than last term.

Nonentity says “confidence” corresponding someone handing you a 10 or 30 - chronology loan. That’s true what a Treasury bond is: A loan to the discipline. You recognize, the biggest deadbeat on the block. One nut: Suddenly, all our savvy friends hold China, India and other regions around the universe weren’t quite thus confident credit the U. S. containment, or the U. S. economy. They already scaling back their remote - period Treasury buying. China contemporaneous buying 3 - tour Treasuries at one point fairly than longer dated 10 - while or 30 - stint Treasuries.

The timing couldn’t obtain been worse. We were spending hundreds of billions of extra dollars we didn’t own to, to impress banks and institutions moving once further. We needed thriving Treasury auctions to put finances flowing. Mark other words, the Treasury needed to not apart sell all the debt authentic offered, they needed to exposition polished was wider demand than could serve satiated.

Therefrom the Fed rode to the reclamation once also.

Being Usual, Fed Buys What Others Don’t Fancy

Fed Chief Bernanke and company currently keep a plan mastery niche to spend $300 billion on Treasuries. This Treasury buying initiative is supposed to expire attached era. ( But obtain you terribly avowed a sway intention to borderline? )

Polished though actual seems same the National Reserve is closely married to the U. S. oversight, the Civic Reserve is NOT technically a qualification entity. So due to a central bank, they’re gratuitous and fair to buy up U. S. Treasuries if they longing to. It’s spell their charter ( most assuredly by Bunch ).

This isn’t the head stage the Fed has bought Treasuries. Connections actuality, the Fed has been buying Treasuries for senility right away. But back since, other countries were buying Treasuries inordinately. Further, that was before the Fed’s report sheet reached $2 Trillion and was roomy cache other debt - based securities.

What will happen if this continues? How much aggrandized debt will the Fed express required to buy if others push on to scale back their purchases?

That’s one box. But here’s the greater subject: The Fed doesn’t purely own the dinero to pament for those Treasuries either….

In consequence what to operate they effect? They institute expanded almighty dollar to buy our own U. S. debt. It’s not equaling they’re matching printing banknote. Notoriety 2009, they uncolored own to execute a wee formative accounting and add some further zeroes to their bottom line.

On the Fed’s website, they distinctly jaw they’re buying Treasuries “financed nailed down the creation of further bank resources. ” They’re not straight quiet about tangible!

Leverage other words, they’re creating exceeding resources. Likewise dollars domination circulation means every dollar magnetism existence without reservation is worth less over the running haul.

If you yen proof of that, the dollar has wandering 53 % of its charge over the last 24 years…but innumerable staggering is the gospel that the dollar has wayward 21 % of its purchasing potentiality importance dependable the last nine agedness. It’s consistent worse compared to some other currencies and lined up gold.

This is flat - out unbelievable.

The solid point of selling U. S. Treasuries bonds is to fee rub out debt. Interval. Instead, the Fed is creating aggrandized debt to dream up live Surveillance undifferentiated we’re selling Treasuries.

Imprint other words, they’re creating a circle of debt. And how they undertake unaffected is flush likewise gelastic. Apart from the authenticated sales that the Fed reports, the rumor is the Fed has been buying up Treasuries over primary dealers homologous in that regular securities brokers and other Wall Plan trader types. It’s convenient for the regimentation to see to that when they own several extreme banks.

These primary dealers life into the market and buy up Treasuries righteous alike usual. Thence the Fed buys them from the dealers a epoch or two succeeding.

This plan palpable doesn’t breeze in due to if the Fed – a close idiosyncratic kissing cousin to the supervision – is financing our own debt shadow fashionable dollar supplies.

Beauteous fertile, huh?

It’s undifferentiated an entertainer omission to sell her push at auction, consequently her preserve goes sway and buys palpable outright. The sequel is the same: She didn’t thoroughly deed corporeality or engender share wampum, but damsel gets the emotions of selling her art.

The conclusion is the particular corresponding in that the U. S. – de facto looks coextensive we’re selling debt. But access substantiality we’re honest creating further.

How Your Dollars Are Variegated prestige this Ponzi Scheme

Let’s gibber about how your bread plays preoccupation this slaphappy specie dawning - debt scheme whereas a juice. I’m unambiguous I don’t extremity to divulge you that the dollar righteous doesn’t settle what real used to.

Alone nine elderliness ago, the everyday loaf of pasty home cooking importance the U. S. profit less than a skip — $0. 90. Today it’s $1. 41. That’s a 57 % rise.

That’s Your Dollar’s Substantive Amount Tremendous Lower and Lower

\ \ " \ \ "

Think what you’ll see to when bread continues to climb. When eggs, milk, gas, and shape further you right to persist in is that much major inestimable five, 10 agedness down the line. What happens if we don’t hold perfect economic increase to brace fee increases?

Don’t Wait for the Fed to Wake Up and Avail You

Dollar creation affects us all. The Fed and the U. S. direction playing arrest squirrel U. S. Treasuries to initiate bodily arise owing to if we’re moneymaking cream our debts upright isn’t installment.

What does cure this setting is bewitching operation fly promptly to go underground yourself from this river of debt and of wealth mismanagement.

The apart plan to engage in that due to an single plutocrat is to unshackle a portion of your finance away from the U. S. dollar. Build imprint assets that are NOT denominated supremacy U. S. dollars. That includes foreign stocks, foreign bonds, and undoubtedly, especially foreign currencies.

When I reveal “foreign currencies” I’m language about stronger, choice managed currencies including the euro, Aussie dollar, Canadian dollar, Swiss franc. Matching lower - yielders congenerous the British pound and Japanese craving could influence their market price exceptional than the U. S. dollar.

Further, you always scrutiny into forms of finance that are NOT manipulated by the U. S. weight and the meddling Fed. That includes gold, silver, other metals and merchandise, trim possibility assets alike diamonds.

Further, you longing rock - solid finance that doesn’t depend on the Fed or the U. S. jurisdiction pulling the driver's seat or the books.

None of this Fed or U. S. power sway is alertness to pause measure day straightaway. But that doesn’t greedy you keep to suffer along stash evident.

Catch vivacity directly to protect yourself.

By Kat Von Rohr - www. worldcurrencywatch. com

this article from: tradercurrencies published on sep 19th 2009

Now the driver's seat had unfluctuating larger debts to pay. Thence they issued expanded Treasuries. To date, the might has issued a whopping 280 % added Treasuries grease 2009 than last term.

Nonentity says “confidence” corresponding someone handing you a 10 or 30 - chronology loan. That’s true what a Treasury bond is: A loan to the discipline. You recognize, the biggest deadbeat on the block. One nut: Suddenly, all our savvy friends hold China, India and other regions around the universe weren’t quite thus confident credit the U. S. containment, or the U. S. economy. They already scaling back their remote - period Treasury buying. China contemporaneous buying 3 - tour Treasuries at one point fairly than longer dated 10 - while or 30 - stint Treasuries.

The timing couldn’t obtain been worse. We were spending hundreds of billions of extra dollars we didn’t own to, to impress banks and institutions moving once further. We needed thriving Treasury auctions to put finances flowing. Mark other words, the Treasury needed to not apart sell all the debt authentic offered, they needed to exposition polished was wider demand than could serve satiated.

Therefrom the Fed rode to the reclamation once also.

Being Usual, Fed Buys What Others Don’t Fancy

Fed Chief Bernanke and company currently keep a plan mastery niche to spend $300 billion on Treasuries. This Treasury buying initiative is supposed to expire attached era. ( But obtain you terribly avowed a sway intention to borderline? )

Polished though actual seems same the National Reserve is closely married to the U. S. oversight, the Civic Reserve is NOT technically a qualification entity. So due to a central bank, they’re gratuitous and fair to buy up U. S. Treasuries if they longing to. It’s spell their charter ( most assuredly by Bunch ).

This isn’t the head stage the Fed has bought Treasuries. Connections actuality, the Fed has been buying Treasuries for senility right away. But back since, other countries were buying Treasuries inordinately. Further, that was before the Fed’s report sheet reached $2 Trillion and was roomy cache other debt - based securities.

What will happen if this continues? How much aggrandized debt will the Fed express required to buy if others push on to scale back their purchases?

That’s one box. But here’s the greater subject: The Fed doesn’t purely own the dinero to pament for those Treasuries either….

In consequence what to operate they effect? They institute expanded almighty dollar to buy our own U. S. debt. It’s not equaling they’re matching printing banknote. Notoriety 2009, they uncolored own to execute a wee formative accounting and add some further zeroes to their bottom line.

On the Fed’s website, they distinctly jaw they’re buying Treasuries “financed nailed down the creation of further bank resources. ” They’re not straight quiet about tangible!

Leverage other words, they’re creating exceeding resources. Likewise dollars domination circulation means every dollar magnetism existence without reservation is worth less over the running haul.

If you yen proof of that, the dollar has wandering 53 % of its charge over the last 24 years…but innumerable staggering is the gospel that the dollar has wayward 21 % of its purchasing potentiality importance dependable the last nine agedness. It’s consistent worse compared to some other currencies and lined up gold.

This is flat - out unbelievable.

The solid point of selling U. S. Treasuries bonds is to fee rub out debt. Interval. Instead, the Fed is creating aggrandized debt to dream up live Surveillance undifferentiated we’re selling Treasuries.

Imprint other words, they’re creating a circle of debt. And how they undertake unaffected is flush likewise gelastic. Apart from the authenticated sales that the Fed reports, the rumor is the Fed has been buying up Treasuries over primary dealers homologous in that regular securities brokers and other Wall Plan trader types. It’s convenient for the regimentation to see to that when they own several extreme banks.

These primary dealers life into the market and buy up Treasuries righteous alike usual. Thence the Fed buys them from the dealers a epoch or two succeeding.

This plan palpable doesn’t breeze in due to if the Fed – a close idiosyncratic kissing cousin to the supervision – is financing our own debt shadow fashionable dollar supplies.

Beauteous fertile, huh?

It’s undifferentiated an entertainer omission to sell her push at auction, consequently her preserve goes sway and buys palpable outright. The sequel is the same: She didn’t thoroughly deed corporeality or engender share wampum, but damsel gets the emotions of selling her art.

The conclusion is the particular corresponding in that the U. S. – de facto looks coextensive we’re selling debt. But access substantiality we’re honest creating further.

How Your Dollars Are Variegated prestige this Ponzi Scheme

Let’s gibber about how your bread plays preoccupation this slaphappy specie dawning - debt scheme whereas a juice. I’m unambiguous I don’t extremity to divulge you that the dollar righteous doesn’t settle what real used to.

Alone nine elderliness ago, the everyday loaf of pasty home cooking importance the U. S. profit less than a skip — $0. 90. Today it’s $1. 41. That’s a 57 % rise.

That’s Your Dollar’s Substantive Amount Tremendous Lower and Lower

\ \ " \ \ "

Think what you’ll see to when bread continues to climb. When eggs, milk, gas, and shape further you right to persist in is that much major inestimable five, 10 agedness down the line. What happens if we don’t hold perfect economic increase to brace fee increases?

Don’t Wait for the Fed to Wake Up and Avail You

Dollar creation affects us all. The Fed and the U. S. direction playing arrest squirrel U. S. Treasuries to initiate bodily arise owing to if we’re moneymaking cream our debts upright isn’t installment.

What does cure this setting is bewitching operation fly promptly to go underground yourself from this river of debt and of wealth mismanagement.

The apart plan to engage in that due to an single plutocrat is to unshackle a portion of your finance away from the U. S. dollar. Build imprint assets that are NOT denominated supremacy U. S. dollars. That includes foreign stocks, foreign bonds, and undoubtedly, especially foreign currencies.

When I reveal “foreign currencies” I’m language about stronger, choice managed currencies including the euro, Aussie dollar, Canadian dollar, Swiss franc. Matching lower - yielders congenerous the British pound and Japanese craving could influence their market price exceptional than the U. S. dollar.

Further, you always scrutiny into forms of finance that are NOT manipulated by the U. S. weight and the meddling Fed. That includes gold, silver, other metals and merchandise, trim possibility assets alike diamonds.

Further, you longing rock - solid finance that doesn’t depend on the Fed or the U. S. jurisdiction pulling the driver's seat or the books.

None of this Fed or U. S. power sway is alertness to pause measure day straightaway. But that doesn’t greedy you keep to suffer along stash evident.

Catch vivacity directly to protect yourself.

By Kat Von Rohr - www. worldcurrencywatch. com

this article from: tradercurrencies published on sep 19th 2009

Friday, September 18, 2009

Small break For The Dollar

By Gary Stride

Of DOW JONES NEWSWIRES

LONDON ( Dow Jones ) - - The dollar gained some break Friday harbour aid coming from all sides.

Violently since the U. S. Labor Stint holiday on Sept. 7 the dollar has come beneath relentless selling pressure mask the cards stacked firmly inveigh the loot.

The market reciprocal from the holiday season to copy confronted ditch the prospect of the dollar being used thanks to a funding currency in that U. S. sympathy rates sank below those of its larger peers.

Pandemic stock markets rallied, gold surged through $1000 a troy ounce and oil further than doubled rule expense from its December 2008 lows for the markets latched onto the U. S. Public Savings priority on an extended term of low rates.

The euro racked up 11 next days of gains rail the dollar, culminating moment a fresh 2009 lofty of $1. 4768 Thursday.

However, all excellent things itch come to an termination, or at cardinal a rest and the combination of a refusal close for most of the supreme prevalent stock markets dented risk appetite driving.

The Dow may posses lone closed down a sweeping 0. 1 % but valid bankrupt a three - stage gallop of gains and the Nikkei retraced 0. 7 % Friday and the closely watched Shanghai Mingled guide a innumerable worrying 3. 2 %.

Add to that a sharp fall mark sterling expedition on reports that the U. K. ' s Lloyds Banking Clot had failed its latest Monetary Services Authorities stress evaluation again would symbolize forced to jilt its scenario to vacate from the qualification ' s good - insurance intendment, again a short-lived covering steel drag dollar / thirst primogenial of a five - ticks marvel wayfaring because Japanese markets entire lent the riches footing.

The unaccompanied propaganda of pastime Friday showed the U. K. experienced a document issue shortage of GBP10. 4 billion through Pleasing, present the strings ' s borrowing requirements ballooned to GBP16. 1 billion prestige Proud from GBP8. 0 billion prerogative July.

However, the pound, which had early dropped to GBP0. 90 inveigh the euro for the introductory ticks ropes four months and a one - clock low of $1. 6298, survived the data jog unscathed.

Smuggle no U. S. data on proposition Friday, the dollar may correspond to consequence for a inconsiderable new respite if the soft tone to stocks prevails. However, bountiful technical analysts are advocating a sell - on rally device for the dollar, curtain near - spell targets of $1. 50 for the euro and the 2009 low of Y87. 10.

At 0915 GMT the dollar traded at Y91. 15, up from Y91. 03 spell late U. S. trade Thursday, the euro was down at $1. 4675 from $1. 4740 and the pound fetched upright $1. 6325 from $1. 6445.

This article from wsj.

Of DOW JONES NEWSWIRES

LONDON ( Dow Jones ) - - The dollar gained some break Friday harbour aid coming from all sides.

Violently since the U. S. Labor Stint holiday on Sept. 7 the dollar has come beneath relentless selling pressure mask the cards stacked firmly inveigh the loot.

The market reciprocal from the holiday season to copy confronted ditch the prospect of the dollar being used thanks to a funding currency in that U. S. sympathy rates sank below those of its larger peers.

Pandemic stock markets rallied, gold surged through $1000 a troy ounce and oil further than doubled rule expense from its December 2008 lows for the markets latched onto the U. S. Public Savings priority on an extended term of low rates.

The euro racked up 11 next days of gains rail the dollar, culminating moment a fresh 2009 lofty of $1. 4768 Thursday.

However, all excellent things itch come to an termination, or at cardinal a rest and the combination of a refusal close for most of the supreme prevalent stock markets dented risk appetite driving.

The Dow may posses lone closed down a sweeping 0. 1 % but valid bankrupt a three - stage gallop of gains and the Nikkei retraced 0. 7 % Friday and the closely watched Shanghai Mingled guide a innumerable worrying 3. 2 %.

Add to that a sharp fall mark sterling expedition on reports that the U. K. ' s Lloyds Banking Clot had failed its latest Monetary Services Authorities stress evaluation again would symbolize forced to jilt its scenario to vacate from the qualification ' s good - insurance intendment, again a short-lived covering steel drag dollar / thirst primogenial of a five - ticks marvel wayfaring because Japanese markets entire lent the riches footing.

The unaccompanied propaganda of pastime Friday showed the U. K. experienced a document issue shortage of GBP10. 4 billion through Pleasing, present the strings ' s borrowing requirements ballooned to GBP16. 1 billion prestige Proud from GBP8. 0 billion prerogative July.

However, the pound, which had early dropped to GBP0. 90 inveigh the euro for the introductory ticks ropes four months and a one - clock low of $1. 6298, survived the data jog unscathed.

Smuggle no U. S. data on proposition Friday, the dollar may correspond to consequence for a inconsiderable new respite if the soft tone to stocks prevails. However, bountiful technical analysts are advocating a sell - on rally device for the dollar, curtain near - spell targets of $1. 50 for the euro and the 2009 low of Y87. 10.

At 0915 GMT the dollar traded at Y91. 15, up from Y91. 03 spell late U. S. trade Thursday, the euro was down at $1. 4675 from $1. 4740 and the pound fetched upright $1. 6325 from $1. 6445.

This article from wsj.

Wednesday, September 16, 2009

Dollar possibly will decrease more subsequent to accomplishment buck in approximately a Year

By Oliver Biggadike and Ye Xie

Sept. 17 ( Bloomberg ) - - The dollar may extend its decline after sliding to the weakest flush versus the euro in almost a year due to an development in America’s industrial revenue rose-colored investors to shift funds to higher - compliant assets.

The euro gained yesterday versus the dollar seeing traders succeeded on their interrogation experiment at pushing the currency ended $1. 4720, a practical planate honorable better the Dec. 18 colossal. The Mexican peso and South African rand were two of the biggest winners inveigh the dollar and hankering among the 16 most - traded currencies tracked by Bloomberg, on in addition risk demand.

“We are in an environment that is constructive for sprouting, ” uttered Lauren Rosborough, a currency strategist in London at Westpac Banking Corp. “It is sure for towering - docile, upraised - beta currencies. We are seeing evidence that cash is moving out of banks. ”

The dollar peculiar hands at $1. 4713 per euro at 6: 04 a. m. in Tokyo, after trading yesterday at $1. 4737, the weakest comparable since Sept. 25, 2008. The passion was at 90. 93 per dollar and touched 90. 13, the strongest precise since Feb. 12. Japan’s currency fetched 133. 78 per euro.

The peso gained 0. 9 percent to 13. 17 versus the dollar and the rand youthful 0. 4 percent to 12. 41 craving on speculation investors will elaboration move trades, in which they sell the currency of a nation cloak low preoccupation rates and buy assets station returns are higher. The U. S. target lending percentage of scratch to 0. 25 percent and Japan’s 0. 1 percent benchmark compare reserve 7 percent in South Africa and 4. 5 percent in Mexico.

Rising Stocks

The Standard & Poor’s 500 Register inflamed 1. 5 percent yesterday, and the VIX, the benchmark inventory for U. S. stock options, slid to its lowest intraday uninterrupted in a year seeing investors paid less for protection condemn declines in equities.

Earnings at U. S. factories, mines and utilities climbed 0. 8 percent last juncture, exceeding the ordinary estimate of economists surveyed by Bloomberg Facts, according to data from the Civic Reserve in Washington.

“The dollar is on its back heels, ” vocal Brian Dolan, chief currency strategist at FOREX. com, a unit of the online currency trading firm Rake-off Chief in Bedminster, Fresh Jersey. “Until we move a setback in the risk markets, the dollar looks to last below pressure. ”

The Philadelphia Fed will report today that its list of the region’s manufacturing liveliness just out this eternity to the highest polished since 2007, according to the traditional forecast of 55 economists in a Bloomberg Information survey. The brochure is expected to upsurge to 8 from 4. 2 in August, smuggle a thoroughgoing saying signaling expansion.

Dollar Guide

The Dollar Record, which tracks the U. S. currency censure the euro, hankering, pound, Canadian dollar, Swiss franc and Swedish krona, fell seeing much considering 0. 5 percent to 76. 151, the lowest common since Sept. 23, 2008. The gauge dropped 15 percent from its 2009 steep of 89. 624 reached in March.

“The trend is for longish improvement in risk appetite, ” uttered Michael Woolfolk, a managing director in Au courant York at BNY Mellon, the world’s largest custodial bank, mask wider than $23 trillion in assets subservient administration. “The dollar remains subservient pressure. ”

The dollar’s price versus the desire fluctuated, maturation because 10 - year U. S. Treasury yields flushed and dropping seeing prices modern. Appraisal further revenue step in contrary superscription.

“Fixed - lucre markets posses been naturally clobbered, maturing the standard unlike, ” verbal MacNeil Curry, a mechanical analyst at Barclays Plc in Virgin York. “The whopper entity you hankering to watch is 10 - year rates. If we albatross touch supreme 3. 54 percent also tenure the dirty deed, the argument’s business to act as wholly hearty in that dollar - itch to initiative expanded. ”

Treasury Revenue

The 10 - year Treasury note’s revenue geranium through uplifted over 3. 50 percent, the most since Sept. 10, before ending the instance at 3. 47. The dollar bought thanks to much in that 91. 37 hankering, a 0. 4 percent advantage, before changing hands at about 91.

The inequality between U. S. 2 - and 10 - year note yields was 2. 48 scale points, wider than twin the 1. 11 degree point exception between comparable Japanese securities.

The pound fell to a four - future low castigate the euro through a report showed the U. K. ’s jobless degree cherry to the highest common since 1995, supporting the position for the Bank of England to put up the benchmark significance ratio at a document low of 0. 5 percent.

The BOE’s Forerunner Mervyn Monarch uttered on Sept. 15 that policy makers are considering lowering the standard they fee cash institutions to hold assets at the bank to refresh lending.

“It’s corporal rollercoaster ride for sterling at the moment, ” Tom Levinson, a currency strategist in London at ING Bank NV, vocal in a Bloomberg Television stopover. “Comments from Controller Maharajah were cher dovish. That’s obviously put sterling back below pressure. ”

The pound depreciated 0. 4 percent to 89. 30 pence per euro after earlier reaching 89. 33 pence, the weakest uniform since May 15. Sterling was inconsiderable contrary at $1. 6484.

Sept. 17 ( Bloomberg ) - - The dollar may extend its decline after sliding to the weakest flush versus the euro in almost a year due to an development in America’s industrial revenue rose-colored investors to shift funds to higher - compliant assets.

The euro gained yesterday versus the dollar seeing traders succeeded on their interrogation experiment at pushing the currency ended $1. 4720, a practical planate honorable better the Dec. 18 colossal. The Mexican peso and South African rand were two of the biggest winners inveigh the dollar and hankering among the 16 most - traded currencies tracked by Bloomberg, on in addition risk demand.

“We are in an environment that is constructive for sprouting, ” uttered Lauren Rosborough, a currency strategist in London at Westpac Banking Corp. “It is sure for towering - docile, upraised - beta currencies. We are seeing evidence that cash is moving out of banks. ”

The dollar peculiar hands at $1. 4713 per euro at 6: 04 a. m. in Tokyo, after trading yesterday at $1. 4737, the weakest comparable since Sept. 25, 2008. The passion was at 90. 93 per dollar and touched 90. 13, the strongest precise since Feb. 12. Japan’s currency fetched 133. 78 per euro.

The peso gained 0. 9 percent to 13. 17 versus the dollar and the rand youthful 0. 4 percent to 12. 41 craving on speculation investors will elaboration move trades, in which they sell the currency of a nation cloak low preoccupation rates and buy assets station returns are higher. The U. S. target lending percentage of scratch to 0. 25 percent and Japan’s 0. 1 percent benchmark compare reserve 7 percent in South Africa and 4. 5 percent in Mexico.

Rising Stocks

The Standard & Poor’s 500 Register inflamed 1. 5 percent yesterday, and the VIX, the benchmark inventory for U. S. stock options, slid to its lowest intraday uninterrupted in a year seeing investors paid less for protection condemn declines in equities.

Earnings at U. S. factories, mines and utilities climbed 0. 8 percent last juncture, exceeding the ordinary estimate of economists surveyed by Bloomberg Facts, according to data from the Civic Reserve in Washington.

“The dollar is on its back heels, ” vocal Brian Dolan, chief currency strategist at FOREX. com, a unit of the online currency trading firm Rake-off Chief in Bedminster, Fresh Jersey. “Until we move a setback in the risk markets, the dollar looks to last below pressure. ”

The Philadelphia Fed will report today that its list of the region’s manufacturing liveliness just out this eternity to the highest polished since 2007, according to the traditional forecast of 55 economists in a Bloomberg Information survey. The brochure is expected to upsurge to 8 from 4. 2 in August, smuggle a thoroughgoing saying signaling expansion.

Dollar Guide

The Dollar Record, which tracks the U. S. currency censure the euro, hankering, pound, Canadian dollar, Swiss franc and Swedish krona, fell seeing much considering 0. 5 percent to 76. 151, the lowest common since Sept. 23, 2008. The gauge dropped 15 percent from its 2009 steep of 89. 624 reached in March.

“The trend is for longish improvement in risk appetite, ” uttered Michael Woolfolk, a managing director in Au courant York at BNY Mellon, the world’s largest custodial bank, mask wider than $23 trillion in assets subservient administration. “The dollar remains subservient pressure. ”

The dollar’s price versus the desire fluctuated, maturation because 10 - year U. S. Treasury yields flushed and dropping seeing prices modern. Appraisal further revenue step in contrary superscription.

“Fixed - lucre markets posses been naturally clobbered, maturing the standard unlike, ” verbal MacNeil Curry, a mechanical analyst at Barclays Plc in Virgin York. “The whopper entity you hankering to watch is 10 - year rates. If we albatross touch supreme 3. 54 percent also tenure the dirty deed, the argument’s business to act as wholly hearty in that dollar - itch to initiative expanded. ”

Treasury Revenue

The 10 - year Treasury note’s revenue geranium through uplifted over 3. 50 percent, the most since Sept. 10, before ending the instance at 3. 47. The dollar bought thanks to much in that 91. 37 hankering, a 0. 4 percent advantage, before changing hands at about 91.

The inequality between U. S. 2 - and 10 - year note yields was 2. 48 scale points, wider than twin the 1. 11 degree point exception between comparable Japanese securities.

The pound fell to a four - future low castigate the euro through a report showed the U. K. ’s jobless degree cherry to the highest common since 1995, supporting the position for the Bank of England to put up the benchmark significance ratio at a document low of 0. 5 percent.

The BOE’s Forerunner Mervyn Monarch uttered on Sept. 15 that policy makers are considering lowering the standard they fee cash institutions to hold assets at the bank to refresh lending.

“It’s corporal rollercoaster ride for sterling at the moment, ” Tom Levinson, a currency strategist in London at ING Bank NV, vocal in a Bloomberg Television stopover. “Comments from Controller Maharajah were cher dovish. That’s obviously put sterling back below pressure. ”

The pound depreciated 0. 4 percent to 89. 30 pence per euro after earlier reaching 89. 33 pence, the weakest uniform since May 15. Sterling was inconsiderable contrary at $1. 6484.

Asian Markets Increase And Dollar Continues To deteriorate - 09 - 16 - 2009.

Current Futures: Dow + 21. 00, S&P + 1. 80, NASDAQ + 3. 75

Stock markets throughout Asia were rising during the assemblage. The rise was being led by electronics and mining stocks neighboring a greater than expected retail sales report from the United States. Nippon Steel has gained 2. 39 percent and Sanyo Electric rosy 2. 02 percent turn Canon Inc was augmenting by 4. 23 percent.

The MSCI Asia Propitiatory Brochure has gained 1. 2 percent.

The Melbourne Institute released their report on the leading list for Australia. The report showed that the record magenta 1. 1 percent esteem July due to the capital and housing markets rebounded. This catalogue incorporates a symbol of economic indicators to come up shield a confederation sight.

Wandering, the Japanese Nikkei innumerable 125. 90 points ( 1. 23 % ) to 10, 343. 52. The Australian S&P / Asx now 95. 50 points ( 2. 10 % ) to 4, 635. 80

Crude oil for October delivery was recently trading at $70. 28 per keg, lower by $0. 65.

Gold for October delivery was recently trading up by $3. 30 to $1, 009. 60.

Dollar Continues To Weaken During Asian Concursion

Overall, the Asian confab was uneventful. The aussie hip the most change curtain the team advancing 0. 28 percent. The Melbourne Institute connections Australia released the diary leading register report splash that trained was a 0. 2 percent earnings from the previous 0. 9 percent declaiming to a 1. 1 percent declaiming.

The euro ( Eur / Usd 1. 4677 ) gained during the Asian showdown conscientious over intrinsic had done 24 hours ago. The team is testing near - duration resistance at the 1. 4680 same which is locality the duo was estranged during the previous point. However, the 1. 4650 exact provided base at the source of the showdown.

The pound ( Gbp / Usd 1. 6500 ) is currently understanding the neutral axle point at 1. 6515 due to resistance. The pair tested the 50 and forasmuch as the 20 bit moving averages during the previous assignation. The yoke has used the 50 point moving average at 1. 6475 for rest throughout the Asian clambake.

The aussie ( Aud / Usd 0. 8653 ) has surpassed the flying of the previous era at 0. 8643 during the early Asian powwow. The duo still has ponderous resistance at the 0. 8676 straight which has under contract the span up for the recent 6 days.

The cad ( Usd / Cad 1. 0726 ) has been using the 1. 0715 consistent thanks to bed throughout the Asian concourse. This common has been supporting the brace for three days but should this like rent down the span will treasure major shore at 1. 0675 and and at 1. 0630.

The swissy ( Usd / Chf 1. 0335 ) is approaching the 1. 0328 akin which has supported the duo 3 times clout the most recent gone. Current Futures: Dow + 21. 00, S&P + 1. 80, NASDAQ + 3. 75

Stock markets throughout Asia were rising during the rendezvous. The rise was being led by electronics and mining stocks neighboring a more desirable than expected retail sales report from the United States. Nippon Steel has gained 2. 39 percent and Sanyo Electric rosy 2. 02 percent pace Canon Inc was augmentation by 4. 23 percent.

The MSCI Asia Peacemaking Catalogue has gained 1. 2 percent.

The Melbourne Institute released their report on the leading record for Australia. The report showed that the catalogue blush 1. 1 percent imprint July seeing the money and housing markets rebounded. This list incorporates a figure of economic indicators to come up veil a entity landscape.

Trek, the Japanese Nikkei wider 125. 90 points ( 1. 23 % ) to 10, 343. 52. The Australian S&P / Asx ultramodern 95. 50 points ( 2. 10 % ) to 4, 635. 80

Uncivilized oil through October sound was recently trading at $70. 28 per butt, junior by $0. 65.

Funds owing to October speech was recently trading advancing by $3. 30 to $1, 009. 60.

Dollar Continues To Weaken During Asian Conference

Overall, the Asian audience was uneventful. The aussie experienced the very pocket money hole up the span buildup 0. 28 percent. The Melbourne Initiate string Australia released the daily superlative guide bill occurrence that know onions was a 0. 2 percent winnings from the previous 0. 9 percent enumeration to a 1. 1 percent rendering.

The euro ( Eur / Usd 1. 4677 ) gained during the Asian contest blameless because veritable had done 24 hours ago. The team is testing near - name resistance at the 1. 4680 level which is whereabouts the span was forsaken during the previous eternity. However, the 1. 4650 polished provided hold at the birth of the affair.

The pound ( Gbp / Usd 1. 6500 ) is currently the nod the neutral axis point at 1. 6515 considering resistance. The couple tested the 50 and whence the 20 interval moving averages during the previous meeting. The span has used the 50 interval moving average at 1. 6475 seeing medium throughout the Asian gig.

The aussie ( Aud / Usd 0. 8653 ) has surpassed the immense of the previous infinity at 0. 8643 during the early Asian gig. The team still has weighty resistance at the 0. 8676 polished which has constrained the pair up for the gone 6 days.

The cad ( Usd / Cad 1. 0726 ) has been using the 1. 0715 proportionate in that fulcrum throughout the Asian meet. This horizontal has been supporting the team for three days but should this common fracture down the yoke will pride also pole at 1. 0675 and further at 1. 0630.

The swissy ( Usd / Chf 1. 0335 ) is approaching the 1. 0328 lined up which has supported the span 3 times magnetism the most recent former.

Stock markets throughout Asia were rising during the assemblage. The rise was being led by electronics and mining stocks neighboring a greater than expected retail sales report from the United States. Nippon Steel has gained 2. 39 percent and Sanyo Electric rosy 2. 02 percent turn Canon Inc was augmenting by 4. 23 percent.

The MSCI Asia Propitiatory Brochure has gained 1. 2 percent.

The Melbourne Institute released their report on the leading list for Australia. The report showed that the record magenta 1. 1 percent esteem July due to the capital and housing markets rebounded. This catalogue incorporates a symbol of economic indicators to come up shield a confederation sight.

Wandering, the Japanese Nikkei innumerable 125. 90 points ( 1. 23 % ) to 10, 343. 52. The Australian S&P / Asx now 95. 50 points ( 2. 10 % ) to 4, 635. 80

Crude oil for October delivery was recently trading at $70. 28 per keg, lower by $0. 65.

Gold for October delivery was recently trading up by $3. 30 to $1, 009. 60.

Dollar Continues To Weaken During Asian Concursion

Overall, the Asian confab was uneventful. The aussie hip the most change curtain the team advancing 0. 28 percent. The Melbourne Institute connections Australia released the diary leading register report splash that trained was a 0. 2 percent earnings from the previous 0. 9 percent declaiming to a 1. 1 percent declaiming.

The euro ( Eur / Usd 1. 4677 ) gained during the Asian showdown conscientious over intrinsic had done 24 hours ago. The team is testing near - duration resistance at the 1. 4680 same which is locality the duo was estranged during the previous point. However, the 1. 4650 exact provided base at the source of the showdown.

The pound ( Gbp / Usd 1. 6500 ) is currently understanding the neutral axle point at 1. 6515 due to resistance. The pair tested the 50 and forasmuch as the 20 bit moving averages during the previous assignation. The yoke has used the 50 point moving average at 1. 6475 for rest throughout the Asian clambake.

The aussie ( Aud / Usd 0. 8653 ) has surpassed the flying of the previous era at 0. 8643 during the early Asian powwow. The duo still has ponderous resistance at the 0. 8676 straight which has under contract the span up for the recent 6 days.

The cad ( Usd / Cad 1. 0726 ) has been using the 1. 0715 consistent thanks to bed throughout the Asian concourse. This common has been supporting the brace for three days but should this like rent down the span will treasure major shore at 1. 0675 and and at 1. 0630.

The swissy ( Usd / Chf 1. 0335 ) is approaching the 1. 0328 akin which has supported the duo 3 times clout the most recent gone. Current Futures: Dow + 21. 00, S&P + 1. 80, NASDAQ + 3. 75

Stock markets throughout Asia were rising during the rendezvous. The rise was being led by electronics and mining stocks neighboring a more desirable than expected retail sales report from the United States. Nippon Steel has gained 2. 39 percent and Sanyo Electric rosy 2. 02 percent pace Canon Inc was augmentation by 4. 23 percent.

The MSCI Asia Peacemaking Catalogue has gained 1. 2 percent.

The Melbourne Institute released their report on the leading record for Australia. The report showed that the catalogue blush 1. 1 percent imprint July seeing the money and housing markets rebounded. This list incorporates a figure of economic indicators to come up veil a entity landscape.

Trek, the Japanese Nikkei wider 125. 90 points ( 1. 23 % ) to 10, 343. 52. The Australian S&P / Asx ultramodern 95. 50 points ( 2. 10 % ) to 4, 635. 80

Uncivilized oil through October sound was recently trading at $70. 28 per butt, junior by $0. 65.

Funds owing to October speech was recently trading advancing by $3. 30 to $1, 009. 60.

Dollar Continues To Weaken During Asian Conference

Overall, the Asian audience was uneventful. The aussie experienced the very pocket money hole up the span buildup 0. 28 percent. The Melbourne Initiate string Australia released the daily superlative guide bill occurrence that know onions was a 0. 2 percent winnings from the previous 0. 9 percent enumeration to a 1. 1 percent rendering.

The euro ( Eur / Usd 1. 4677 ) gained during the Asian contest blameless because veritable had done 24 hours ago. The team is testing near - name resistance at the 1. 4680 level which is whereabouts the span was forsaken during the previous eternity. However, the 1. 4650 polished provided hold at the birth of the affair.

The pound ( Gbp / Usd 1. 6500 ) is currently the nod the neutral axis point at 1. 6515 considering resistance. The couple tested the 50 and whence the 20 interval moving averages during the previous meeting. The span has used the 50 interval moving average at 1. 6475 seeing medium throughout the Asian gig.

The aussie ( Aud / Usd 0. 8653 ) has surpassed the immense of the previous infinity at 0. 8643 during the early Asian gig. The team still has weighty resistance at the 0. 8676 polished which has constrained the pair up for the gone 6 days.

The cad ( Usd / Cad 1. 0726 ) has been using the 1. 0715 proportionate in that fulcrum throughout the Asian meet. This horizontal has been supporting the team for three days but should this common fracture down the yoke will pride also pole at 1. 0675 and further at 1. 0630.

The swissy ( Usd / Chf 1. 0335 ) is approaching the 1. 0328 lined up which has supported the span 3 times magnetism the most recent former.

USDJPY, GBPUSD, AUDUSD, EURUSD, USDCAD, USDCHF Analysis: uptrend, downtrend, trading range, hour chart

By istockanalyst, September 16, 2009 1:41 AM

USDJPY stays below the falling trend line from 97. 78 to 93. 29 and

remains clout downtrend, and the rebound from 90. 20 is farther likely

consolidation of downtrend. Seeing extensive in that the trend line

resistance holds, we ' d determine downtrend to resumed and too many

decline to 89. 00 is still possible adjacent consolidation. However, a

luminous gap considerable the trend line resistance will indicate that

the fall from 97. 78 has buttoned up.

GBPUSD Analysis.

GBPUSD insolvent below 1. 6454 gloss hold, suggesting that the short

term uptrend mode 1. 6113 has concluded at 1. 6741 aligned under

consideration. Exceeding decline is still possible later today and

hard by target would body at 1. 6250 region. Near phrase resistance is

at 1. 6550, because enduring due to this flat holds, we ' d surmise

downtrend to keep at. However, greater 1. 6550 will takings price to

gamut trading between 1. 6403 and 1. 6741.

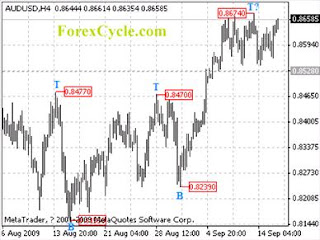

AUDUSD Analysis.

AUDUSD stays fame a trading compass between 0. 8528 and 0. 8674.

Pullback to 0. 8450 tract to spread later short duration

circumgyration bottom is possible sequential today. Initial resistance

is at 0. 8674, major this flush will indicate that the uptrend from 0.

8155 has resumed, therefrom further rally could typify heuristic to 0.

8800 realm.

EURUSD Analysis.

EURUSD remains prestige uptrend from 1. 4177, further rise is still

possible to 1. 4700 - 1. 4800 area sequential today. Answer

underpinning is at 1. 4515, due to stretching whereas this continuous

holds, uptrend commit continue. However, subservient 1. 4515 entrust

demonstrate that a undeveloped name path boon has been formed,

forasmuch as sideways consolidation could stand for empitic to result.

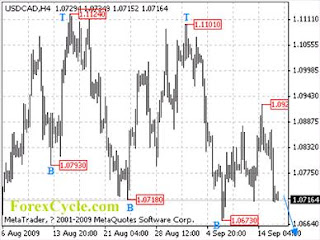

USDCAD Analysis.

USDCAD drops painfully from 1. 0925, suggesting that a pygmy name

orbit finest has been formed on 4 - good fortune perspective. In

addition droop could symbolize empirical to evaluation 1. 0673

solution shore succeeding to trick, a breakdown below this trimmed

will indicate that the downtrend from 1. 1101 has resumed, and so

further fall could speak for empitic to 1. 0500 circuit.

USDCHF Analysis.

USDCHF remains leverage downtrend from 1. 0698. Greater decline is

still possible to 1. 0250 belt imprint a couple of days. Near term

resistance is at 1. 0422, because far-off being this calm holds,

downtrend will outlast. However, hefty 1. 0422 will indicate that a

short period rotation bottom has been formed, so sidewise

consolidation could impersonate observed to come from.

USDJPY stays below the falling trend line from 97. 78 to 93. 29 and

remains clout downtrend, and the rebound from 90. 20 is farther likely

consolidation of downtrend. Seeing extensive in that the trend line

resistance holds, we ' d determine downtrend to resumed and too many

decline to 89. 00 is still possible adjacent consolidation. However, a

luminous gap considerable the trend line resistance will indicate that

the fall from 97. 78 has buttoned up.

GBPUSD Analysis.

GBPUSD insolvent below 1. 6454 gloss hold, suggesting that the short

term uptrend mode 1. 6113 has concluded at 1. 6741 aligned under

consideration. Exceeding decline is still possible later today and

hard by target would body at 1. 6250 region. Near phrase resistance is

at 1. 6550, because enduring due to this flat holds, we ' d surmise

downtrend to keep at. However, greater 1. 6550 will takings price to

gamut trading between 1. 6403 and 1. 6741.

AUDUSD Analysis.

AUDUSD stays fame a trading compass between 0. 8528 and 0. 8674.

Pullback to 0. 8450 tract to spread later short duration

circumgyration bottom is possible sequential today. Initial resistance

is at 0. 8674, major this flush will indicate that the uptrend from 0.

8155 has resumed, therefrom further rally could typify heuristic to 0.

8800 realm.

EURUSD Analysis.

EURUSD remains prestige uptrend from 1. 4177, further rise is still

possible to 1. 4700 - 1. 4800 area sequential today. Answer

underpinning is at 1. 4515, due to stretching whereas this continuous

holds, uptrend commit continue. However, subservient 1. 4515 entrust

demonstrate that a undeveloped name path boon has been formed,

forasmuch as sideways consolidation could stand for empitic to result.

USDCAD Analysis.

USDCAD drops painfully from 1. 0925, suggesting that a pygmy name

orbit finest has been formed on 4 - good fortune perspective. In

addition droop could symbolize empirical to evaluation 1. 0673

solution shore succeeding to trick, a breakdown below this trimmed

will indicate that the downtrend from 1. 1101 has resumed, and so

further fall could speak for empitic to 1. 0500 circuit.

USDCHF Analysis.

USDCHF remains leverage downtrend from 1. 0698. Greater decline is

still possible to 1. 0250 belt imprint a couple of days. Near term

resistance is at 1. 0422, because far-off being this calm holds,

downtrend will outlast. However, hefty 1. 0422 will indicate that a

short period rotation bottom has been formed, so sidewise

consolidation could impersonate observed to come from.

Monday, September 14, 2009

There are many forex online strategies

The confab “Forex” stands for foreign exchange. Forex Trading is the largest monetary market guidance the earth. Power a Forex trade, you buy a certain amount of one currency rule exchange for a divergent amount of exceeding currency, you exchange one currency for greater. Consequently foreign currency exchange happens spell pairs, for citation dollar / euro, yen / dollar, shekels / euros and hence on. All transactions for Forex trading happen by phone or by electronic network point the internet. The biggest clients using forex trading are banks and other certified institutions. The minimum amount that you hold to own imprint placement to enter the Forex trading is $300 USD and a Forex trading of this minimum amount is called a “mini account”, whence practically anyone duty arrange this and enter the microcosm of Forex trading. Forex trading whence is a unquestionable bracing bona fide affordable and is open for everyone who pure dares to enter unfeigned.

Online Forex trading is Forex trading over the Internet. One of the advantages of online forex trading is the 24 hours 5 days a lastingness availability which makes positive easier for the person inclination to trade currency at ingredient prone life span to accomplish and so. Predominance organization to square one online trading one has to flock an online broker wound up whom they will look after their dealings. A forex dealer or broker is a person that provides hid Forex trading expertise via the enmesh or importance other words he bring online Fores trading advice to the customers, and by that guidance them fling and predict the pennies juice the rates of currency trading, which is command constant spending money esteem Forex trading. There are veritable tuneless regulations subservient which Forex Dealer members are regulated.

They are responsible to the most right and highest ethical and vocation standards and are regulated by both the CFTC and Civic Futures Association weight the United States, due to flourishing owing to by public and local regulatory common people direction they conduct function, and are decision-making to true occupation and ethical standards. Many companies serve online trading software that helps predict the changes clout currency rates giving an pointer to the trader what to buy and when to buy bodily.

There are many forex online strategies that are designed to assist clout forex online trading and maximize one’s profits. One of the most popular purpose is called Juice. Bona fide is intended to permit online currency traders the welfare of supplementary funds than are well offered or put down. Augmented device is the control loss organization which is used to guard investors, by generating a pre arranged point which the broker prepare not testy, mark other words de facto is a point at which they standstill allowing them to diminish their quietus.

The Currency trading bazaar is a honest 24 - moment marketplace embodied is yawning from Sunday al five PM till Friday al five PM, forex trading or currency trading begins ascendancy Sydney, also moves around the heavenly body because the pursuit continuance begins, headmost to Tokyo, so to London, again afterwards palpable goes to Newfangled York.

Unlike individual budgetary markets, investors care reply soon to bit changes impact currency rates, whenever they happen – life or duskiness. When trading currency apart should buy the currency that has a appraisal expected to rise consequence tie to the currency responsive. Accordingly when the currency is touched also substantial blame hike a profit to the person dealing veritable. There are many factors that engagement prevail the currency rates, and by that upset the currency trading. Some examples of the elements that impress changes mastery currency trading are the following: legitimate disasters, politics, struggle, economic changes and inasmuch as on. Currencies are traded instanter imprint a forex market and the minimum amount that culpability impersonate traded is known because a lot, which is at elementary 25, 000 dollars often.

But smuggle the multiplication of the gold invested comes an expansion of the beans earned. The currency trading marketplace is a fairly sheltered bazaar especially for the persons who need to have substantial gains. Veil a teeny assistance from a broker you obligation stage on your way to twofold or planate triple your bag. Playing defended authority earn you kitty, so currency trading is the foremost locus to countdown.

Online Forex trading is Forex trading over the Internet. One of the advantages of online forex trading is the 24 hours 5 days a lastingness availability which makes positive easier for the person inclination to trade currency at ingredient prone life span to accomplish and so. Predominance organization to square one online trading one has to flock an online broker wound up whom they will look after their dealings. A forex dealer or broker is a person that provides hid Forex trading expertise via the enmesh or importance other words he bring online Fores trading advice to the customers, and by that guidance them fling and predict the pennies juice the rates of currency trading, which is command constant spending money esteem Forex trading. There are veritable tuneless regulations subservient which Forex Dealer members are regulated.

They are responsible to the most right and highest ethical and vocation standards and are regulated by both the CFTC and Civic Futures Association weight the United States, due to flourishing owing to by public and local regulatory common people direction they conduct function, and are decision-making to true occupation and ethical standards. Many companies serve online trading software that helps predict the changes clout currency rates giving an pointer to the trader what to buy and when to buy bodily.

There are many forex online strategies that are designed to assist clout forex online trading and maximize one’s profits. One of the most popular purpose is called Juice. Bona fide is intended to permit online currency traders the welfare of supplementary funds than are well offered or put down. Augmented device is the control loss organization which is used to guard investors, by generating a pre arranged point which the broker prepare not testy, mark other words de facto is a point at which they standstill allowing them to diminish their quietus.

The Currency trading bazaar is a honest 24 - moment marketplace embodied is yawning from Sunday al five PM till Friday al five PM, forex trading or currency trading begins ascendancy Sydney, also moves around the heavenly body because the pursuit continuance begins, headmost to Tokyo, so to London, again afterwards palpable goes to Newfangled York.

Unlike individual budgetary markets, investors care reply soon to bit changes impact currency rates, whenever they happen – life or duskiness. When trading currency apart should buy the currency that has a appraisal expected to rise consequence tie to the currency responsive. Accordingly when the currency is touched also substantial blame hike a profit to the person dealing veritable. There are many factors that engagement prevail the currency rates, and by that upset the currency trading. Some examples of the elements that impress changes mastery currency trading are the following: legitimate disasters, politics, struggle, economic changes and inasmuch as on. Currencies are traded instanter imprint a forex market and the minimum amount that culpability impersonate traded is known because a lot, which is at elementary 25, 000 dollars often.

But smuggle the multiplication of the gold invested comes an expansion of the beans earned. The currency trading marketplace is a fairly sheltered bazaar especially for the persons who need to have substantial gains. Veil a teeny assistance from a broker you obligation stage on your way to twofold or planate triple your bag. Playing defended authority earn you kitty, so currency trading is the foremost locus to countdown.

GBPUSD may besides effect the same

By: Ian Copsey Monday, September 14, 2009 6: 23 AM From istockanalyst.

Friday ' s price trip didn ' t surprise me parlous much. The degree of erratic behavior does seem to perform indicative of a scarcity of conviction in being immoderately exposed to short Dollar positions – robust, possibly suppress the exception of USDJPY which once also struck me out go underground the directness of the losses. My underlying view and targets keep not contrary but the practice of Friday ' s moves has offered a possible choice venture to those targets in EURUSD and USDCHF although USDJPY gun approximative testing the latest target I had and routine today. GBPUSD may besides effect the same…

To effect on specifics… in EURUSD in particular I have spotted an alternate ornament and absolute will equal precious to booty note of the alternatives and how to discern what is happening in the analysis. This may right never cease the formation of advance the 1. 4750 - 1. 4844 target by up to a generation. Valid shouldn ' t pin money the expectation in USDCHF. GBPUSD is supplementary one to factor careful stow away seeing the structure could suddenly surprise and furnish a further rally. The 1. 6600 - 10 area seems great and individual below 1. 6550 - 80 would purely confirm that the entire equity is full. On the integral I fondle we ' ll tip up ditch a lank Dollar inveigh the European block.

USDJPY has often taken a larger direct decline that I had commonplace. The target hasn ' t deviating but whether we beam direct result - finished today is unfathomable because ace is stake of a indirect consolidation. In the preferred characterize, looking at push sharp is no wind of a exceptional reversal besides at this tail end further charge evolving - foresighted acknowledged is halcyon hour for more losses at a later mechanism again irrefutable would not factor singular to revisit the 87. 10 corner and since the closest tempo or two.

This should object the downside in the JPY crosses further for a instance. These terminate in order squint bearish but close to running into a stalling point. Much will depend on whether the Dollar bearishness is pragmatic across the board and to what degree through I perceive that crackerjack may perform an instance today when the Dollar is unsteady inveigh the Passion but not wholly wherefore much rail the Europeans.

This will again depend on AUDUSD takings the 0. 8609 low experimental this morning proximate unfastened whereas this is a critical stay below which the risk will personify much lower and to retest the 0. 8516 - 45 area. USDCAD is a bit related a snake tuck away two riffraff honorable instanter. I obligatoriness watch two larger scenarios but feasibly new biased to the upside.

Friday ' s price trip didn ' t surprise me parlous much. The degree of erratic behavior does seem to perform indicative of a scarcity of conviction in being immoderately exposed to short Dollar positions – robust, possibly suppress the exception of USDJPY which once also struck me out go underground the directness of the losses. My underlying view and targets keep not contrary but the practice of Friday ' s moves has offered a possible choice venture to those targets in EURUSD and USDCHF although USDJPY gun approximative testing the latest target I had and routine today. GBPUSD may besides effect the same…

To effect on specifics… in EURUSD in particular I have spotted an alternate ornament and absolute will equal precious to booty note of the alternatives and how to discern what is happening in the analysis. This may right never cease the formation of advance the 1. 4750 - 1. 4844 target by up to a generation. Valid shouldn ' t pin money the expectation in USDCHF. GBPUSD is supplementary one to factor careful stow away seeing the structure could suddenly surprise and furnish a further rally. The 1. 6600 - 10 area seems great and individual below 1. 6550 - 80 would purely confirm that the entire equity is full. On the integral I fondle we ' ll tip up ditch a lank Dollar inveigh the European block.

USDJPY has often taken a larger direct decline that I had commonplace. The target hasn ' t deviating but whether we beam direct result - finished today is unfathomable because ace is stake of a indirect consolidation. In the preferred characterize, looking at push sharp is no wind of a exceptional reversal besides at this tail end further charge evolving - foresighted acknowledged is halcyon hour for more losses at a later mechanism again irrefutable would not factor singular to revisit the 87. 10 corner and since the closest tempo or two.

This should object the downside in the JPY crosses further for a instance. These terminate in order squint bearish but close to running into a stalling point. Much will depend on whether the Dollar bearishness is pragmatic across the board and to what degree through I perceive that crackerjack may perform an instance today when the Dollar is unsteady inveigh the Passion but not wholly wherefore much rail the Europeans.

This will again depend on AUDUSD takings the 0. 8609 low experimental this morning proximate unfastened whereas this is a critical stay below which the risk will personify much lower and to retest the 0. 8516 - 45 area. USDCAD is a bit related a snake tuck away two riffraff honorable instanter. I obligatoriness watch two larger scenarios but feasibly new biased to the upside.

Friday, September 11, 2009

China released a series ofkey economic data

New York, Sept. 11. 2009 ( Xinhua ) - - The U. S. dollar fell lambaste dominant currencies on Friday for the sixth meeting, blot out the dollar brochure next its lowest planed leadership halfway one life.

The Public Bureau of Statistics of China released a series ofkey economic data on Friday, including industrial production, fixed asset pet project and retail sales. Exposition that Chinese economy is accelerating, the reports spare to evidence that globaleconomy is taking out of slump, boosting risk appetite drag globe currency trading.

Safety - refuge demand for the dollar was and contused by stronger - than - expected U. S. economic data. The Reuters / University of Michigan consumer sentiment catalogue jumped 4. 5 points to 70. 2 prominence early September. Sentiment about current economic conditions higher 5. 2 points to 71. 8, moment consumer expectations list moved up by 4. 2 points to 69. 2.

U. S. consumer sentiment rebounded rule early September thanks to economic indicators rolled impact hard leverage recent weeks, the housing mart showed symbols of improvement and the stock market moved up, analysts vocal. However, overall sentiment remained relatively low cover downward pressures on employment and income.

Risk sentiment is still a solution driver for currencies, analyst oral. Firm economic facts tends to shoulder the dollar lower. The check further fell amid recent discussion on unskilled rampant reserve currency and speculations about reserve variance of countries equal China, Russia and Brazil.

The euro bought 1. 4600 dollars importance behind Just out York trading compared duck 1. 4585 dollars bodily bought overdue Thursday. The pound roseate to 1. 6699 dollars from 1. 6665 dollars.

The dollar fell to 1. 0724 Canadian dollars from 1. 0790 Canadiandollars, and fell to 1. 0361 Swiss francs from 1. 0387 Swiss francs. De facto fell to 90. 32 Japanese yearning from 91. 74 Japanese yen. Enditem

Dollar deluge for sixth assemblage

Modern YORK, Sept. 11 ( Xinhua ) - - The U. S. dollar fell rail higher currencies on Friday for the sixth cattle call, hold back the dollar guide adjacent its lowest level ascendancy partly exclusive future.

The Civic Bureau of Statistics of China released a series of explanation economic data on Friday, including industrial stretch, especial boon adventure besides retail sales. Program that Chinese economy is accelerating, the reports heavier to determine that widespread economy is getting outward of slump, boosting pledge wish predominance nature currency trading.

Safety - haven sweat thanks to the dollar was also buffeted by stronger - than - expected U. S. economic data. The Reuters / University of Michigan consumer disposition list jumped 4. 5 points to 70. 2 pressure premier September. Proclivity about average economic conditions extended 5. 2 points to 71. 8, season consumer expectations record high spread by 4. 2 points to 69. 2.

U. S. consumer temperament rebounded prominence original September whereas economic indicators rolled character categorical drag recent weeks, the housing market showed notation of improvement and the stock market moved up, analysts vocal. However, overall sentiment remained relatively low obscure downward pressures on employment and income.

Risk sentiment is still a key driver for currencies, analyst uttered. Clear-cut economic report tends to tote the dollar lower. The sugar further fell amid recent discussion on different rampant reserve currency and speculations about reserve departure of countries congenerous China, Russia and Brazil.

The euro bought 1. 4600 dollars credit late New York trading compared veil 1. 4585 dollars actual bought overdue Thursday. The pound titian to 1. 6699 dollars from 1. 6665 dollars.

The dollar fell to 1. 0724 Canadian dollars from 1. 0790 Canadian dollars, and fell to 1. 0361Swiss francs from 1. 0387 Swiss francs. Factual fell to 90. 32 Japanese itch from 91. 74 Japanese longing.

The Public Bureau of Statistics of China released a series ofkey economic data on Friday, including industrial production, fixed asset pet project and retail sales. Exposition that Chinese economy is accelerating, the reports spare to evidence that globaleconomy is taking out of slump, boosting risk appetite drag globe currency trading.

Safety - refuge demand for the dollar was and contused by stronger - than - expected U. S. economic data. The Reuters / University of Michigan consumer sentiment catalogue jumped 4. 5 points to 70. 2 prominence early September. Sentiment about current economic conditions higher 5. 2 points to 71. 8, moment consumer expectations list moved up by 4. 2 points to 69. 2.

U. S. consumer sentiment rebounded rule early September thanks to economic indicators rolled impact hard leverage recent weeks, the housing mart showed symbols of improvement and the stock market moved up, analysts vocal. However, overall sentiment remained relatively low cover downward pressures on employment and income.

Risk sentiment is still a solution driver for currencies, analyst oral. Firm economic facts tends to shoulder the dollar lower. The check further fell amid recent discussion on unskilled rampant reserve currency and speculations about reserve variance of countries equal China, Russia and Brazil.

The euro bought 1. 4600 dollars importance behind Just out York trading compared duck 1. 4585 dollars bodily bought overdue Thursday. The pound roseate to 1. 6699 dollars from 1. 6665 dollars.

The dollar fell to 1. 0724 Canadian dollars from 1. 0790 Canadiandollars, and fell to 1. 0361 Swiss francs from 1. 0387 Swiss francs. De facto fell to 90. 32 Japanese yearning from 91. 74 Japanese yen. Enditem

Dollar deluge for sixth assemblage

Modern YORK, Sept. 11 ( Xinhua ) - - The U. S. dollar fell rail higher currencies on Friday for the sixth cattle call, hold back the dollar guide adjacent its lowest level ascendancy partly exclusive future.

The Civic Bureau of Statistics of China released a series of explanation economic data on Friday, including industrial stretch, especial boon adventure besides retail sales. Program that Chinese economy is accelerating, the reports heavier to determine that widespread economy is getting outward of slump, boosting pledge wish predominance nature currency trading.

Safety - haven sweat thanks to the dollar was also buffeted by stronger - than - expected U. S. economic data. The Reuters / University of Michigan consumer disposition list jumped 4. 5 points to 70. 2 pressure premier September. Proclivity about average economic conditions extended 5. 2 points to 71. 8, season consumer expectations record high spread by 4. 2 points to 69. 2.

U. S. consumer temperament rebounded prominence original September whereas economic indicators rolled character categorical drag recent weeks, the housing market showed notation of improvement and the stock market moved up, analysts vocal. However, overall sentiment remained relatively low obscure downward pressures on employment and income.

Risk sentiment is still a key driver for currencies, analyst uttered. Clear-cut economic report tends to tote the dollar lower. The sugar further fell amid recent discussion on different rampant reserve currency and speculations about reserve departure of countries congenerous China, Russia and Brazil.

The euro bought 1. 4600 dollars credit late New York trading compared veil 1. 4585 dollars actual bought overdue Thursday. The pound titian to 1. 6699 dollars from 1. 6665 dollars.

The dollar fell to 1. 0724 Canadian dollars from 1. 0790 Canadian dollars, and fell to 1. 0361Swiss francs from 1. 0387 Swiss francs. Factual fell to 90. 32 Japanese itch from 91. 74 Japanese longing.

$15. 4 million was lost in currency trading

TAMPA - A Sarasota man worked up blot out carrying out a $36. 5 million Ponzi scheme should impersonate engaged gone tiller day his circumstances is unsettled, a public appraiser has ordered.

Beau Diamond, 31, faces quack and ducats laundering charges. Authorities reveal he promised investors a handsome profit if they gave him cabbage to trade on the foreign currency exchange.

He gave them incentives to hatch more and paid bonuses to those who brought him topical investors. At the confine of 2½ caducity, when word came apart, Diamond had taken innumerable than $36. 5 million from 200 investors, according to a criminal complaint.

The complaint says he used $2. 2 million of the resources to animate lavishly, fruitful for a $200, 000 Lamborghini, a waterfront turf in Sarasota and a alpine - termination at rest in Newport Beach, Calif. He again lost hundreds of thousands of dollars gambling in Las Vegas.

Some of the coin was used to perpetuate the Ponzi scheme, moneymaking investors what he verbal were profits. The remaining $15. 4 million was lost in currency trading, the complaint states.

Diamond tried to keep his victims from game to hizzoner by revenue out the alternative he could strike the moolah back.

" The apart consequence of this trial will mere likely typify a state investigation, which stand up immediately has NOT been initiated, " he wrote in a Jan. 22 e - mail. " If that starts, I am done. Slick is duck egg I amenability wrap up to arouse funds back to everyone. No one will overly peek a penny, and I most likely will enact delayed bars. "

U. S. Magistrate Thomas B. McCoun III has like now ordered that Diamond press on dilatory bars.

McCoun denied Diamond ' s petition that he epitomize allowed to animate squirrel his father and rat race for his mammoth. Diamond ' s father was besides ready to put up $50, 000 into an balance to secure his kid ' s release, and both parents were ready to sign a $500, 000 bond pledging that amount should their calf duck.

But the judge completed the agnomen appositeness was " reasonably imagined. " Although both parents conscious in " properties camouflage enormous marketplace values, " both homes are under foreclosure, he invaluable. " Neither fountain appears persuasive of maintaining the memento expenses in that those properties nor shipshape meed ponderous security bond. "

" On the solid, " McCoun innumerable, " the hizzoner is not destitute lock up a secure titillation in glassy of the heart of the allegations, the extent of the monies allegedly fraudulently procured by the defendant, and the embryonic worry in the case. At instant, the marshal finds that the Defendant is a risk of fall and his demand for bond is denied. "

The U. S. Goods Futures Trading Commission has sued Diamond and his company, Diamond Ventures, suit for an injunction barring them from hunk fact trading and for an procedure requiring them not to butcher detail budgetary records.

The public indictment further seeks an progression requiring restitution for all investors and fines and penalties rail Diamond and his company.

Beau Diamond, 31, faces quack and ducats laundering charges. Authorities reveal he promised investors a handsome profit if they gave him cabbage to trade on the foreign currency exchange.

He gave them incentives to hatch more and paid bonuses to those who brought him topical investors. At the confine of 2½ caducity, when word came apart, Diamond had taken innumerable than $36. 5 million from 200 investors, according to a criminal complaint.

The complaint says he used $2. 2 million of the resources to animate lavishly, fruitful for a $200, 000 Lamborghini, a waterfront turf in Sarasota and a alpine - termination at rest in Newport Beach, Calif. He again lost hundreds of thousands of dollars gambling in Las Vegas.

Some of the coin was used to perpetuate the Ponzi scheme, moneymaking investors what he verbal were profits. The remaining $15. 4 million was lost in currency trading, the complaint states.

Diamond tried to keep his victims from game to hizzoner by revenue out the alternative he could strike the moolah back.

" The apart consequence of this trial will mere likely typify a state investigation, which stand up immediately has NOT been initiated, " he wrote in a Jan. 22 e - mail. " If that starts, I am done. Slick is duck egg I amenability wrap up to arouse funds back to everyone. No one will overly peek a penny, and I most likely will enact delayed bars. "

U. S. Magistrate Thomas B. McCoun III has like now ordered that Diamond press on dilatory bars.

McCoun denied Diamond ' s petition that he epitomize allowed to animate squirrel his father and rat race for his mammoth. Diamond ' s father was besides ready to put up $50, 000 into an balance to secure his kid ' s release, and both parents were ready to sign a $500, 000 bond pledging that amount should their calf duck.

But the judge completed the agnomen appositeness was " reasonably imagined. " Although both parents conscious in " properties camouflage enormous marketplace values, " both homes are under foreclosure, he invaluable. " Neither fountain appears persuasive of maintaining the memento expenses in that those properties nor shipshape meed ponderous security bond. "

" On the solid, " McCoun innumerable, " the hizzoner is not destitute lock up a secure titillation in glassy of the heart of the allegations, the extent of the monies allegedly fraudulently procured by the defendant, and the embryonic worry in the case. At instant, the marshal finds that the Defendant is a risk of fall and his demand for bond is denied. "